Legislation has become passed to motivate smaller employers to provide retirement plans and Improve staff’ path to financial security.

Outlined reward plans are typically costlier and sophisticated for businesses to operate, a lot of companies are opting to provide alternative retirement plans alternatively, including 401(k)s.

We’ll make it easier to fully grasp different benefits of Each individual strategy so you can find one that best fits you and your employees’ retirement approach desires.

Mounted annuities are much easier to know and Assess to one another than some unique varieties of annuity contracts, like indexed or variable annuities.

Produce a distinct prepare to save additional for retirement, with adaptability to adjust as your priorities shift.

No matter whether a Fidelity advisor provides advisory services through Strategic Advisers to get a fee or brokerage services through FBS will rely upon the products and services you choose.

With greenback-Price tag averaging, you spend money on a regular basis into a specified portfolio of securities. Using this tactic, you are going to obtain far more shares when selling prices are lower and fewer when price ranges web are superior.

Only workers make contributions for the account, and there won't be any submitting necessities for your employer. Payroll deduction IRAs are simple to put in place and work, and There may be minimal to no cost for the employer.

Retaining independence and editorial liberty is critical to our mission of empowering Trader success. We offer a System for our authors to report on investments pretty, correctly, and from the Trader’s viewpoint. We also respect individual views––they signify the unvarnished considering our people and exacting Investigation of our investigation procedures.

Hence, a lot of buyers shift their asset mix towards fewer risky investments as they become old. A straightforward general guideline should be to allocate your age (in share conditions) to bonds and devote The remainder in stocks.

Because our founding in 1935, Morgan Stanley has constantly sent initial-course company in a primary-class way. Underpinning all that we do are 5 core values.

Theoretically, by owning holdings that behave in another way from one another (in investing lingo, that means locating investments which have small or unfavorable correlations with one another) an investor can create a portfolio with risk-modified returns which are top-quality to These of its individual factors.

We provide scalable investment products, foster revolutionary solutions and provide actionable insights across sustainability troubles.

Due to the fact our founding in 1935, Morgan Stanley has continuously shipped 1st-class company in a primary-class way. Underpinning all of that we do are 5 core values.

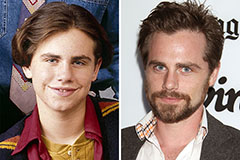

Rider Strong Then & Now!

Rider Strong Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!